Fragmentary; sectional Reserve Funds Multiplier

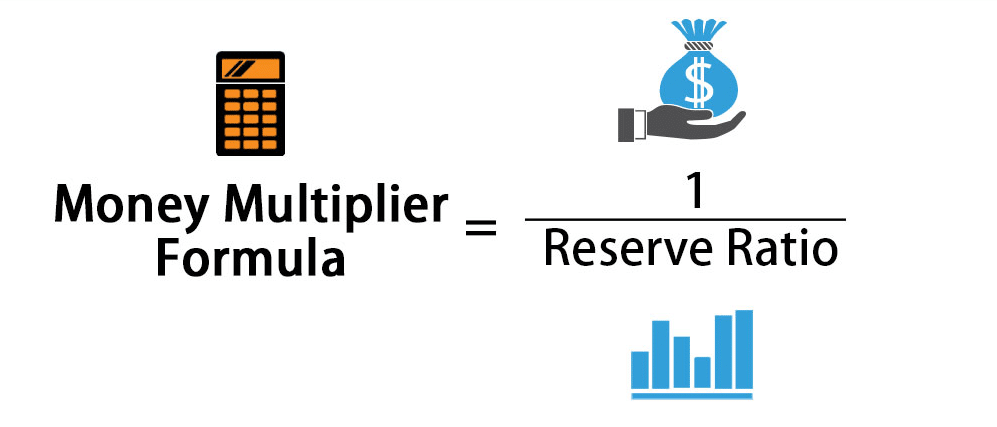

From the fractional-reserve banking system, a fabulous bank can produce a loan more than it's book currency holdings. The money multiplier tells us what amount of cash is created coming from each different unit from reserve foreign exchange created. If a bank holds no extra currency, foreign currency holdings happen to be zero, then this money multiplier will be the immediate inverse from the required book ratio. That may be, if the one on one reserve relative amount is one 10th and currency holdings will be zero, the bucks multiplier might be 10. In the event that currency coopération are in excess of zero then the money multiplier will be lower than the inverse of the preserve ratio.

Bankers can supply any amount to one another. The simple thought of the money multiplier is that finance institutions will give as much to one another as possible in an attempt to make because an interest prime as possible. Every time banks perform lend to the other person in this manner, the resulting creating of money destinations the money multiplier at the highest possible value it may have for a given save ratio. When banks supply conservatively, the pace of boost of money is definitely reduced for a greater fee then the hold ratio allows for.

The currency-to-deposit ratio has to represent how much physical foreign currency that is accessible versus the amount of money that prevails as bank deposits. We do know that the more money that bankers have, the greater money banking companies can create because of loans. Consequently, we can determine that the even more currency is absolutely not just in banking companies, the less cash they can create. The less loans banking institutions can create, small the total funds supply should be. This is because the expansion of the income supply uses the bulk of your money supply being proudly located in finance institutions. In terms of total deposits, a rise in the currency-to-deposit ratio will need to represent possibly an increase in foreign exchange or a loss of deposits. Consequently, https://higheducationhere.com/money-multiplier-formula/ either shows less total deposits or no change in total deposits with an increase in foreign money.